Unlock Your Dream Home with Fintech Zoom Mortgage – Fast & Easy

The dream of homeownership is a significant milestone for many, but the traditional mortgage process can often be daunting and time-consuming. Enter Fintech Zoom Mortgage, a revolutionary platform that leverages cutting-edge financial technology to streamline and simplify the mortgage process. In this blog post, we’ll explore how you can unlock your dream home with Fintech Zoom Mortgage, highlighting its features, benefits, and the steps to secure a mortgage through this innovative service.

Table of Contents

Understanding Fintech Zoom Mortgage

Overview of Fintech Zoom as a Platform

Fintech Zoom Mortgage is more than just a tool; it’s a comprehensive platform that integrates every step of the mortgage process. From initial inquiry to final approval, Fintech Zoom uses advanced algorithms and machine learning to provide a seamless user experience. It supports a wide range of mortgage products, including traditional fixed-rate mortgages, adjustable-rate options, and refinancing.

Services and Solutions Offered

Fintech Zoom Mortgage excels with:

- Instant Pre-Approval: Real-time data processing for quick pre-approval.

- Automated Underwriting System: Reduces paperwork and minimizes human error.

- Customizable Loan Features: Adjust terms to fit your financial situation.

Key Differentiators

Fintech Zoom stands out by:

- User-Friendly Interface: Easy navigation and access to resources.

- Educational Tools: Guides and tools to help you understand mortgage options.

- Competitive Rates: Leveraging technology for the best terms and conditions.

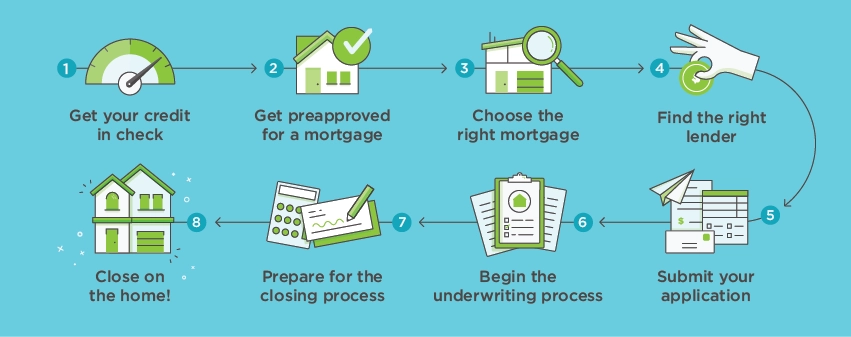

Step-by-Step Guide to Applying for a Mortgage Through Fintech Zoom

Pre-Application Preparation

Before you start, gather:

- Financial Documents: Pay stubs, tax records, bank statements.

- Credit Score Information: To anticipate loan terms.

- Calculator Tools: To gauge borrowing capacity and potential payments.

Step 1: Creating an Account with Fintech Zoom

- Sign Up: Visit Fintech Zoom and register with your details.

- Account Verification: Confirm your account via email.

Step 2: Filling Out the Application

- Enter Personal and Financial Information: Income, employment history, assets, and debts.

- Provide Property Details: If you have chosen a property.

- Select Loan Type: Fixed-rate, adjustable-rate, refinancing, etc.

Step 3: Documentation and Verification

- Upload Documents: Securely via the platform.

- Automated Verification: Quick checks of your details.

Step 4: Tracking Application Status

- Monitor Real-Time Updates: Through your dashboard.

- Final Approval: Review and digitally sign your loan agreement.

Tips for a Smooth Approval Process

- Ensure Accuracy: Double-check all provided information.

- Stay Informed: Utilize Fintech Zoom’s resources.

- Communicate: Reach out to customer support with any questions.

The Evolution of Mortgages: Traditional vs. Fintech Solutions

Traditional Mortgage Processes

Traditionally, securing a mortgage involved:

- Complicated Paperwork: Extensive documentation and forms.

- Face-to-Face Meetings: Multiple visits to banks or brokers.

- Lengthy Waits: Weeks or even months for approval.

- Manual Risk Assessment: Time-consuming underwriting processes.

Introduction of Fintech in Mortgages

Fintech has transformed this process by:

- Streamlining Applications: Online forms and immediate document uploads.

- Speeding Up Underwriting: Automated systems that reduce decision times.

- Real-Time Updates: Continuous tracking of your application status.

- Personalized Offers: Tailored mortgage options based on your financial profile.

How Fintech Zoom is Changing the Mortgage Landscape

Impact of Technology on Mortgage Processing

Fintech Zoom leverages technology to:

- Speed Up Data Analysis: Quick evaluation of creditworthiness and risk.

- Enhance Transparency: Real-time updates and clear communication.

- Reduce Errors and Bias: Automated systems ensure fair assessments.

Case Studies of Success

Consider a first-time homebuyer who:

- Uploaded Documents Online: Avoiding traditional paperwork.

- Received Immediate Feedback: On loan options and pre-approval status.

- Customized Loan Terms: To match financial goals, secure a mortgage with attractive rates.

Automation and Real-Time Processing Benefits

Automation and real-time processing offer:

- Reduced Human Input: Lower risk of errors and biases.

- Equitable Treatment: Decisions based on complete financial data.

- Enhanced Trust: Transparent and efficient mortgage processes.

Read Also: 10 Best Principles of UX Design

Frequently Asked Questions (FAQs) About Fintech Zoom Mortgage

What is Fintech Zoom Mortgage?

Fintech Zoom Mortgage is an online platform that simplifies the mortgage process using advanced technology.

How does Fintech Zoom Mortgage streamline the mortgage process?

By automating underwriting, offering instant pre-approval, and providing real-time updates.

What types of mortgages can I apply for on Fintech Zoom Mortgage?

Options include fixed-rate, adjustable-rate, and refinancing loans.

Are there any fees associated with using Fintech Zoom Mortgage?

Yes, but the fee structure is transparent and often lower than traditional lenders.

How does Fintech Zoom Mortgage compare to conventional banks?

It offers faster processing, lower rates, and a more user-friendly experience.

Is my personal and financial information safe with Fintech Zoom Mortgage?

Yes, the platform uses secure encryption to protect your data.

Can I get pre-approved for a mortgage on Fintech Zoom Mortgage?

Yes, instant pre-approval is available for eligible applicants.

What documentation will I need to apply for a mortgage with Fintech Zoom Mortgage?

Financial documents such as pay stubs, tax records, and bank statements.

How long does it take to get a mortgage approved through Fintech Zoom Mortgage?

Approval times are significantly reduced, often within hours or days.

What should I do if I encounter issues or have questions during the application process?

Contact Fintech Zoom’s customer support for assistance.

Call to Action

Ready to unlock your dream home with Fintech Zoom Mortgage? Visit Fintech Zoom to explore your options and start your path to tech-driven homeownership today.

Conclusion

Unlocking your dream home with Fintech Zoom Mortgage is not only possible but also easier than ever. By leveraging advanced technology, Fintech Zoom simplifies the traditionally cumbersome mortgage process, offering competitive rates, customizable loan options, and a user-friendly experience. For those considering a mortgage, Fintech Zoom provides a seamless and well-informed borrowing journey.