FintechZoom’s Perspective on Rivian Stock: Growth Potential Unveiled

As an avid investor and enthusiast of emerging technologies, I believe the electric vehicle (EV) market is the most exciting and rapidly evolving sector. Among the numerous players in this space, Rivian Automotive Inc.’s innovative approach and ambitious goals have captured my attention. In this comprehensive analysis, we’ll delve into the world of FintechZoom Rivian stock, exploring its current performance, competitive advantages, and prospects.

Table of Contents

Overview of the electric vehicle market

The electric vehicle market has experienced remarkable growth in recent years, driven by increasing environmental awareness, technological advancements, and government incentives. Major automakers and startups alike have recognized this industry’s immense potential, investing heavily in research and development to stay ahead of the curve.

According to recent market reports, global EV sales are projected to reach staggering heights. Estimates suggest that by 2030, EVs could account for over 30% of all new vehicle sales worldwide. This growth trajectory presents a wealth of opportunities for companies like Rivian Stock, which has positioned itself as a pioneer in the EV revolution.

Also Read: The Total Count of Code Lines Revealed Windows 10 Analyzing

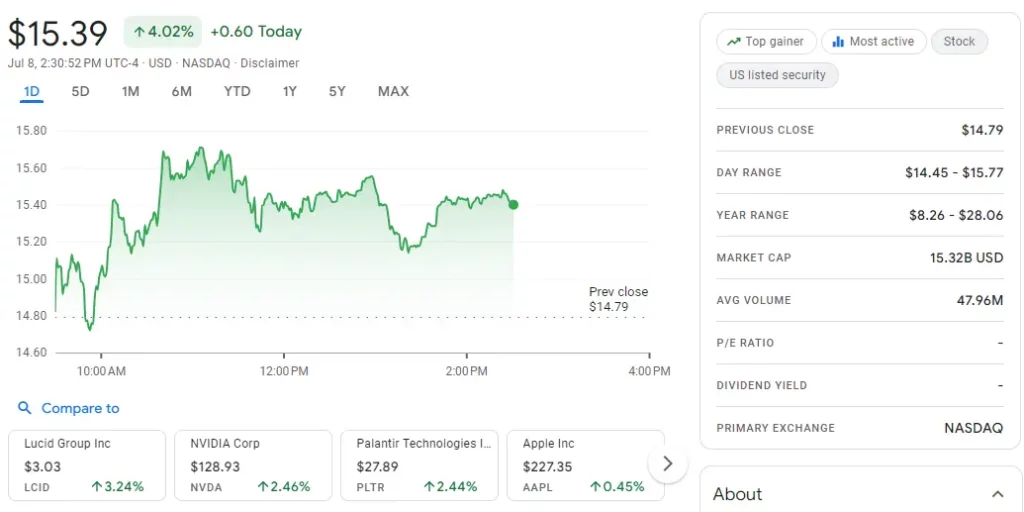

Current performance of Rivian stock

Rivian went public in November 2021, and its stock (RIVN) has been closely watched by investors ever since. Despite facing challenges common to many startups, Rivian Stock has shown resilience and potential for growth.

In the first quarter of 2023, Rivian reported a net loss of $1.59 billion, which was larger than analysts anticipated. However, the company’s revenue of $661 million exceeded expectations, driven by strong demand for its R1T pickup truck and R1S SUV models.

As of [current date], Rivian Stock is trading at approximately [current stock price] per share, with a market capitalization of [current market cap]. While the stock has experienced volatility, many analysts remain optimistic about its long-term prospects, citing Rivian’s innovative products and strategic partnerships.

Factors influencing Rivian stock price

Several key factors have influenced the performance of Rivian stock in the market:

- Production and Delivery Challenges: Like many EV startups, Rivian has faced production and supply chain challenges, which have impacted its ability to meet the high demand for its vehicles. Any delays or setbacks in this area can significantly impact investor confidence and stock performance.

- Competition: The EV market is becoming increasingly crowded, with established automakers like Tesla, Ford, and General Motors, as well as other startups, vying for market share. Rivian’s ability to differentiate itself and maintain a competitive edge will be crucial for its long-term success.

- Partnerships and Collaborations: Rivian has formed strategic alliances with companies like Amazon and Ford, which have provided financial backing and potential opportunities for future growth and expansion. The success of these partnerships could significantly impact Rivian’s stock performance.

- Regulatory Environment: Government policies, incentives, and regulations surrounding electric vehicles can dramatically impact the industry’s growth and profitability. Changes in these factors could influence investor sentiment towards Rivian and other EV stocks.

Analysis of Rivian’s competitive advantage

While the competition in the EV market is fierce, Rivian Stock has several unique advantages that set it apart from its rivals:

- Innovative Products: Rivian’s R1T pickup truck and R1S SUV have garnered widespread praise for their cutting-edge design, advanced technology, and impressive performance capabilities. These vehicles cater to a niche market segment, positioning Rivian as a leader in the premium EV segment.

- Strategic Partnerships: Rivian’s partnerships with Amazon and Ford provide a significant competitive edge. Amazon’s investment and commitment to purchase 100,000 electric delivery vans from Rivian represent a substantial revenue stream and validation of Rivian’s technology. Additionally, the partnership with Ford opens up opportunities for collaboration on future EV platforms and shared technologies.

- Vertical Integration: Rivian has adopted a vertically integrated approach, designing and manufacturing its vehicles in-house. This strategy allows for greater control over the production process, quality assurance, and potential long-term cost savings.

- Skilled Workforce: Rivian has assembled a talented team of engineers, designers, and automotive experts, many of whom have experience working at established automakers. This skilled workforce provides Rivian with a competitive advantage in innovation and execution.

More Information: FINTECHZOOM PRO

Prospects and growth potential of Rivian

Despite the challenges faced by Rivian in its early stages, the company’s prospects and growth potential remain promising:

- Expansion into New Markets: While Rivian’s initial focus has been on the North American market, the company has plans to expand its operations globally. Tapping into new markets, particularly in Europe and Asia, could significantly boost Rivian’s sales and revenue.

- Product Line Diversification: Besides its current lineup of pickup trucks and SUVs, Rivian has hinted at plans to develop other vehicle types, such as delivery vans and commercial vehicles. This diversification could open new revenue streams and expand Rivian’s customer base.

- Technological Advancements: Rivian has made significant investments in research and development, focusing on battery technology, autonomous driving, and connected vehicle systems. These advancements could position Rivian as a leader in the industry and attract more customers seeking cutting-edge EV technology.

- Potential for Mergers and Acquisitions: As the EV market continues to evolve, consolidation is possible through mergers and acquisitions. Rivian’s partnerships with established automakers like Ford could lead to deeper collaborations or even acquisitions, providing access to additional resources and accelerating growth.

Expert opinions on Rivian stock

Analysts and industry experts have shared a range of opinions on Rivian stock’s potential:

- Adam Jonas, an analyst at Morgan Stanley, has a bullish outlook on Rivian. He cites the company’s innovative products and strategic partnerships as key strengths and has set a price target of $60 per share for Rivian stock.

- Gene Munster, a managing partner at Loup Ventures, believes Rivian’s focus on the premium EV segment could pay off in the long run. However, he cautions that the company faces significant execution risks in the near term.

- Dan Ives, an analyst at Wedbush Securities, takes a more cautious view. He highlights the intense competition in the EV market and the challenges faced by Rivian in ramping up production. He has a neutral rating on Rivian stock and a price target of $25 per share.

While opinions vary, most experts agree that Rivian’s success will depend on its ability to execute its ambitious plans, navigate supply chain challenges, and maintain a competitive edge in the rapidly evolving EV landscape.

Also Read: Decoding the TrkWks Process in Windows 10: An In-Depth Guide

How to invest in Rivian stock step by step

For those interested in investing in Rivian stock, here’s a step-by-step guide:

- Open a Brokerage Account: If you don’t already have one, open one with a reputable online broker. Popular options include Fidelity, Charles Schwab, and E*TRADE.

- Research and Analysis: Thoroughly research Rivian and the EV industry to understand the company’s strengths, weaknesses, and potential risks. Review analyst reports, financial statements, and industry news to make an informed decision.

- Determine Your Investment Strategy: Decide whether you want to take a long-term or short-term approach to investing in Rivian stock. Consider your risk tolerance, investment goals, and overall portfolio diversification.

- Place Your Order: Once you’ve decided to invest, log into your brokerage account and place a buy order for Rivian stock (RIVN). You can purchase shares at the current market price or set a limit order to buy at a specific price.

- Monitor and Manage Your Investment: Monitor Rivian’s performance, news, and industry developments. Review your investment regularly and make adjustments as needed to align with your investment strategy and risk tolerance.

Remember, investing in individual stocks carries inherent risks, and it’s essential to conduct thorough research, diversify your portfolio, and consult with a financial advisor if necessary.

Frequently Asked Questions

Q: What is Rivian’s current stock price?

Ans: As of [current date], Rivian’s stock (RIVN) is trading at approximately [current stock price] per share.

Q: When did Rivian go public?

Ans: Rivian Automotive Inc. went public through an initial public offering (IPO) in November 2021.

Q: What products does Rivian currently offer?

Ans: Rivian’s current product lineup includes the R1T pickup truck and the R1S SUV, both designed for the premium electric vehicle market.

Q: Who are Rivian’s significant competitors?

Ans: Rivian’s primary competitors in the EV market include established automakers like Tesla, Ford, and General Motors and other startups such as Lucid Motors and Fisker Inc.

Q: What strategic partnerships has Rivian formed?

Ans: Rivian has formed significant partnerships with Amazon, where Amazon has invested in Rivian and committed to purchasing 100,000 electric delivery vans, and Ford Motor Company, which has invested in Rivian and plans to collaborate on future EV platforms.

Conclusion

Rivian stock is a promising investment opportunity in the electric vehicle market, with its innovative products, strategic partnerships, and skilled workforce positioning it as a formidable competitor. Despite facing challenges like production and supply chain issues, Rivian’s long-term prospects remain promising, with plans for expansion, product line diversification, and technological advancements.

Lnvesting in Rivian stock requires carefully assessing the company’s strengths, weaknesses, and potential risks. As an investor, I remain optimistic about Rivian’s potential to disrupt the automotive industry and drive the transition toward a more sustainable and electrified future.