Protect Yourself from Venmo Scams: Stay One Step Ahead

As more and more people embrace a digital era, more sophisticated mobile payment platforms, including Venmo, have become popular as a way of making payments due to their convenience and relative ease of use. On the other, this rise in digital transactions has further opened up new ways of scamming unsuspecting users.

As a result, scams over Venmo have begun to be more of a problem over time and have left many people at risk of financial loss or even criminal activity regarding their identity. Allow me, as an experienced writer, to take you through some of the intricacies of Venmo scams in order to arm you with the knowledge that could protect you and make you wiser.

Table of Contents

Types of Venmo Scams to Watch Out For

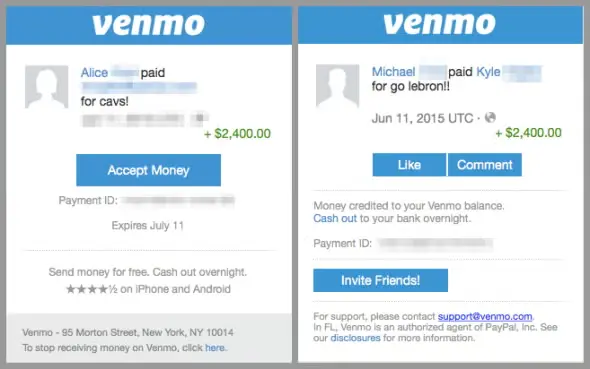

- Fake Payment Scams: A scammer will send a notification of some phoney payment to you, claiming that you have received money from one of your friends or any of your family members. Subsequently, they will ask you to “refund” the payment to make you transfer real money.

- Phishing Scams: This can include digitally creating fake login pages or phishing emails from Venmo and asking for a set of your login credentials or other sensitive information.

- Overpayment scams: This is when the scammer sends an overpayment for an item or service and then asks for a refund of the “excess” that was sent, leaving the user’s account negative in Venmo.

- Fraudulent buyer scams: These are scams whereby some individuals pose as buyers on Craigslist or Facebook Marketplace and promise to pay via Venmo, only to dispute the transaction after they’ve received and left the victims with little more than possibly very harmful consequences.

- Hacked Account Scams: Scammers steal the Venmo user’s account through phishing or other activities; after that, they use the account to send illegitimate payments or request money from the victim’s contacts.

Common Red Flags and Warning Signs of Venmo Scams

- Unsolicited requests for payment: Be wary of any unsolicited request for payment that you get, most especially if from an unknown contact.

- Urgent or suspicious requests: Many times, scammers may be urgent to get you to take action now with high-pressure tactics.

- Requests for sensitive information: No legitimate representative will ever ask you for your login credentials for Venmo or any other personal information via email or text message.

- Unusual Amount of Payment: Anything that is unusually high or low in payment requests can raise a red flag to indicate a scam.

- Sender Can’t Be Independently Verified: If you cannot verify the person or company sending the request for payment independently, it is always better to be on the safe side.

Tips to Protect Yourself from Venmo Scams

- Enable Security Features: Avail the built-in Venmo security features like two-factor authentication and setting up a PIN or biometric login.

- Verify Requests for Payment: Be sure of who you are sending or receiving money from.

- Never Refund Overpayment: If you have been overpaid, do not give any refund. You should immediately contact the sender to clear this issue.

- Be Cautious with Unfamiliar Contacts: When a request for payment or messages comes from an unknown individual, one should be a lot more careful.

- Monitor your Venmo Activity: Keep a regular review of your transactions and account activity on Venmo to identify suspicious activity as early as possible.

Best Practices for Secure Transactions on Venmo

- Limit Venmo to Known Contacts Only: Use Venmo only with friends and family members whom you know well enough and whom you would trust to keep their details secure.

- Avoid Using Venmo for Business Transactions: You can use a dedicated business payment platform for commercial transactions.

- Keep Your Venmo Account Private: Avoid making your username or QR code public; this will expose you as a potential target to scammers.

- Use a Strong, Unique Password: Use a strong and unique password for Venmo, and don’t use it anywhere else.

- Be cautious when on public Wi-Fi: It is never advised to use Venmo on public Wi-Fi since these types of networks are mostly not very secure.

Reporting Venmo Scams and Seeking Help

If you think you are the victim of a scammer using Venmo, take instant action. The first step to take in this regard is to contact the Venmo support team and specify the incident of fraud, asking for their help. Apart from that, you also have the right to file a complaint with the Federal Trade Commission site or local law enforcement agency.

Resources to Stay Updated on the Latest Venmo Scam Trends

I recommend periodic checking with trusted sources, such as the Venmo blog, consumer protection through the FTC website, and other reputable cybersecurity news outlets, for fresh information on the current trends in Venmo scams and best practices.

Real-Life Examples of Venmo Scams and Their Consequences

Let’s look at a few real-life examples of Venmo scams and their results.

- The Fake Payment Scam: A college student received an In Transit Venmo payment notification from a “friend,” asking her to refund the money. Believing it was a real transaction, she gave the money back, only to discover that the initial payment was phoney, which left her with a negative balance on her Venmo account.

- Hacked Account Scam: A person’s account in the Venmo app was hacked, and then the scammer sent fake requests for money to his friends. Several of his friends apparently fell into the trap and suffered serious financial damage.

- The Overpayment Scam: A small business owner had sold something on Craigslist and got overpaid through Venmo. Subsequently, the “buyer” asked for a refund of the “excess” amount, thus leaving the business owner with a negative balance and no item payment.

These examples are but a small view of the very real, often devastating, effects caused by victimization through Venmo scams. You can be proactive in learning about the many varieties of scams and how to apply the best practices outlined in this article to protect yourself and your finances.

Also Read: Small Business Website Design for Optimal User Experience

Frequently Asked Questions

Q: I got scammed through Venmo. What am I supposed to do now?

A: If you have fallen victim to one of these Venmo scams, the first thing you should do is immediately contact the support team at Venmo. They can sometimes dispute a fraudulent transaction and reclaim access to your account. You’ll want to report this incident to the FTC and your local law enforcement agency.

Q: Does Venmo refund money lost to scams?

A: Venmo will refund on conditions under which the user lost money due to a scam and they acted in good faith and according to its terms of service. But there is no guarantee, and one must still go the extra mile to keep scammers at bay.

Q: How will I know if a Venmo payment request is legit?

A: Know your requester. Be cautious of suspicious requesters or abnormally large requests from individuals. Be suspicious of high-pressure tactics or requests for sensitive information.

Q: Is it safe to use Venmo for business?

A: In reality, Venmo is meant for more personal, peer-to-peer payments. It is not a platform to conduct your business. You need a business account that has higher security and better protection for conducting business.

Q: To whom can I report a Venmo scam?

A: You can report a scam on Venmo by calling their support group, filling a complaint with the FTC, and reporting such an incident to your local law enforcement agencies. Please provide them with as much detailed information as possible to help investigate and recover lost funds.

To stay updated on the latest Venmo scam trends and learn more about protecting your financial security, I encourage you to visit the [Venmo blog] and the [FTC’s consumer protection website]. By staying informed and proactive, you can take the necessary steps to safeguard your Venmo transactions and avoid falling victim to these increasingly sophisticated scams.

Conclusion

Most Venmo scams are genuinely threatening to the financial health of users. Otherwise, if you are informed and take preventive measures, you are good to stay ahead of the bad guys. Knowing what the different kinds of scams are, looking out for warning signs, and using best practices in transactions will enable you to enjoy the convenience of using Venmo while minimizing the chances of being victimized. Remember, vigilance and information are your best allies when it comes to keeping your Venmo account secure and intact.