Importance of 409A Valuation for Startups

As an entrepreneur navigating the intricate world of startups, I understand the paramount importance of making informed decisions that can significantly impact the trajectory of your venture. One crucial aspect that often falls under the radar is the 409A valuation. This process carries substantial weight for startups seeking to attract and retain top talent while mitigating potential legal and financial risks. In this comprehensive guide, we will delve into the intricacies of 409A valuations, exploring their significance, the underlying processes, and the benefits they offer startups.

Table of Contents

What is a 409A valuation?

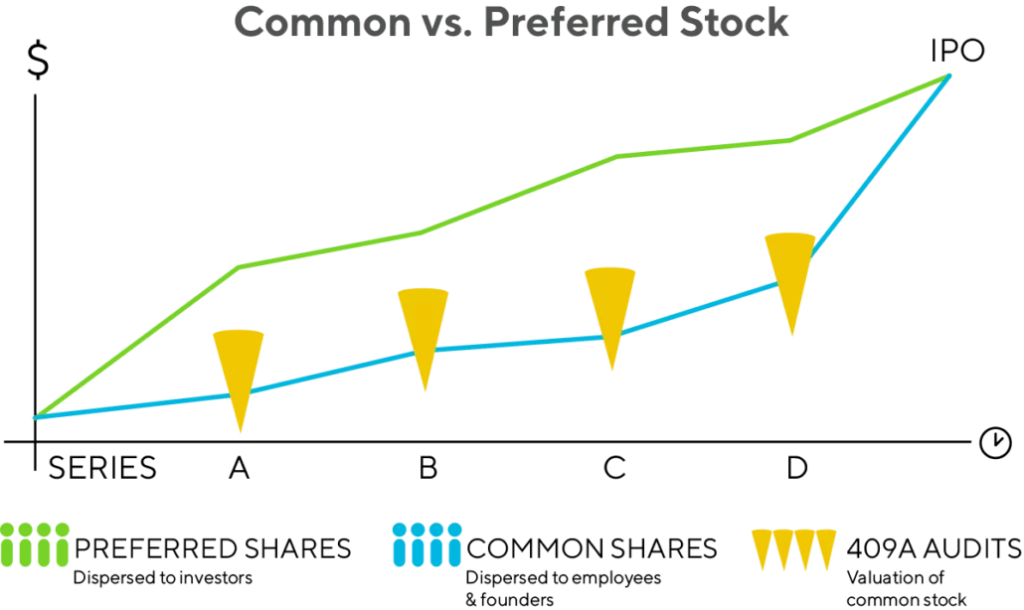

A 409A valuation, named after Section 409A of the Internal Revenue Code, is a formal appraisal of a private company’s fair market value. This valuation is conducted by an independent, third-party appraiser who employs industry-standard methodologies to determine the worth of a company’s common stock. The primary purpose of a 409A valuation is to establish a defensible and compliant strike price for stock options granted to employees and service providers.

Why is a 409A valuation important for startups?

The significance of a 409A valuation for startups cannot be overstated. Here are a few compelling reasons why it is a critical undertaking:

- Compliance with IRS Regulations: Failure to comply with 409A regulations can result in severe tax consequences for the company and its employees. A properly conducted 409A valuation helps ensure compliance, mitigating the risk of potential penalties and fines.

- Fair Compensation for Employees: By accurately determining the fair market value of a company’s stock, a 409A valuation ensures that employees are fairly compensated for their contributions through stock options or other equity-based incentives.

- Attracting and Retaining Top Talent: In the competitive startup landscape, offering competitive equity-based compensation packages is crucial for attracting and retaining top talent. A 409A valuation provides the foundation for creating such packages.

- Investor Confidence: Investors often scrutinize a startup’s 409A valuation to measure its financial health and potential for growth. A well-executed valuation can instill confidence in potential investors and facilitate future funding rounds.

409A valuation important for startups for 409A Valuations

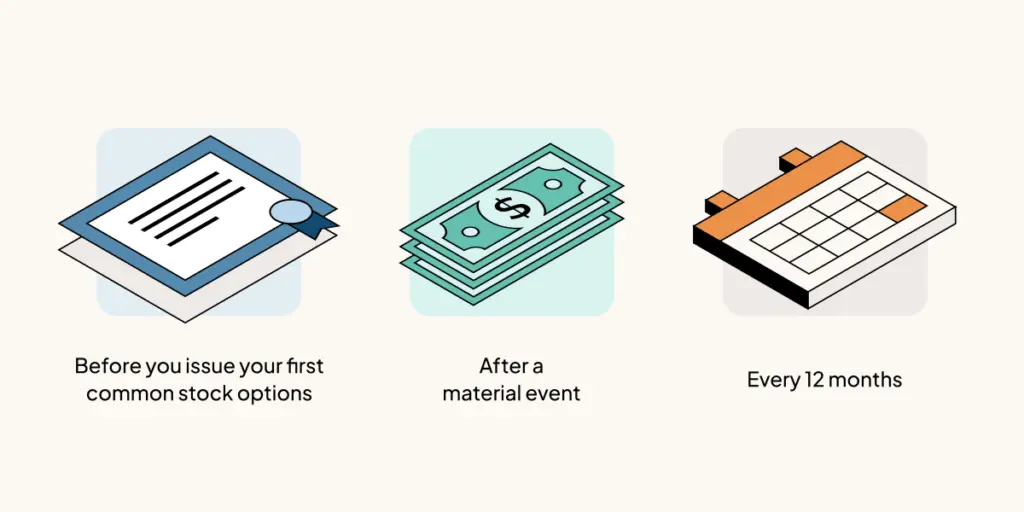

Compliance with 409A regulations is a legal obligation for startups, and failure to adhere to these requirements can have severe consequences. The IRS mandates that private companies conduct 409A valuations at specific intervals, typically:

- Initial Valuation: A 409A valuation must be performed before the first equity compensation grant is made to employees or service providers.

- Annual Valuations: Subsequent valuations are required at least once every 12 months or more frequently if significant events could impact the company’s value.

- Event-Based Valuations: Certain events, such as equity financing rounds, mergers, acquisitions, or significant changes in the company’s operations or financial performance, may necessitate an interim 409A valuation.

It is crucial to consult with legal and tax professionals to ensure that your startup remains compliant with the ever-evolving 409A regulations.

The Process of Conducting a 409A Valuation

The process of conducting a 409A valuation is a multi-faceted endeavor that involves several key steps:

- Engaging a Qualified Appraiser: The first step is to employ a qualified, independent appraiser specializing in 409A valuations. These professionals possess the necessary expertise and experience to navigate the complexities of the valuation process.

- Data Gathering: The appraiser will request a comprehensive set of financial and operational data from the company, including financial statements, capitalization tables, business plans, and other relevant information.

- Methodology Selection: Based on the company’s stage, industry, and specific circumstances, the appraiser will select the appropriate valuation methodologies. Common approaches include the income approach, market approach, and asset-based approach.

- Valuation Analysis: The appraiser will apply the chosen methodologies to analyze the company’s financial performance, market position, and growth potential, ultimately arriving at a fair market value for the company’s common stock.

- Report Preparation: The appraiser will document the valuation process, methodologies, assumptions, and conclusions in a comprehensive report, which is the official 409A valuation document.

- Implementation: Once the valuation report is finalized, the company can use the determined fair market value to set the strike price for stock options or other equity-based compensation.

Factors Considered in a 409A Valuation

A 409A valuation is a comprehensive analysis that considers many factors, both quantitative and qualitative. Some of the critical factors considered by appraisers include:

- Financial Performance: The company’s historical and projected financial performance, including revenue, profitability, and cash flow, are crucial in the valuation process.

- Market Conditions: The appraiser will analyze the industry landscape, market trends, and competitive dynamics to assess the company’s position and growth potential.

- Intellectual Property: The value of a company’s intellectual property, such as patents, trademarks, and proprietary technology, can significantly impact its overall valuation.

- Management Team: The management team’s experience, expertise, and track record are essential factors in determining the company’s ability to execute its business plan and achieve success.

- Growth Prospects: The company’s growth prospects, including its ability to scale operations, enter new markets, and develop new products or services, are critical considerations in the valuation process.

- Risk Factors: Appraisers will assess various risk factors, such as regulatory risks, market risks, and operational risks, that could impact the company’s future performance and valuation.

Also Read: Effortless BIOS Access on Windows 10: Skip the Restart

Common Challenges Faced in 409A Valuations for Startups

While 409A valuations are essential for startups, the process has been challenging. Some of the common hurdles encountered include:

- Limited Financial History: Early-stage startups often need more financial data and operational history, making it challenging for appraisers to project future performance and assess risk factors accurately.

- Rapidly Changing Landscape: The dynamic nature of the startup ecosystem, with rapidly evolving technologies, market trends, and competitive landscapes, can make it challenging to value a company’s long-term prospects accurately.

- Subjective Assumptions: Valuations inherently involve subjective assumptions and judgments, which can lead to differences in opinion between appraisers, companies, and regulatory bodies.

- Timing Considerations: Determining the appropriate timing for conducting a 409A valuation can be challenging, as significant events or changes in the company’s circumstances may necessitate more frequent valuations.

- Cost and Resource Constraints: Engaging professional appraisers and conducting thorough valuations can be costly and resource-intensive, particularly for early-stage startups with limited budgets.

Despite these challenges, startups must navigate the 409A valuation process effectively, seeking guidance from experienced professionals and adhering to best practices to mitigate potential risks and ensure compliance.

Benefits of Obtaining a 409A Valuation for Startups

While the process of obtaining a 409A valuation may seem daunting, the benefits it provides to startups are manifold:

- Compliance and Risk Mitigation: By adhering to 409A regulations and conducting timely valuations, startups can mitigate the risk of potential penalties, fines, and legal disputes, safeguarding their financial interests and those of their employees.

- Competitive Compensation Packages: A 409A valuation enables startups to offer competitive equity-based compensation packages, attracting and retaining top talent in a highly competitive job market.

- Investor Confidence: A well-executed 409A valuation demonstrates a startup’s commitment to transparency, good governance, and adherence to industry best practices, instilling confidence in potential investors.

- Informed Decision-Making: The insights gained from a 409A valuation can inform strategic decision-making processes, such as fundraising strategies, exit planning, and long-term growth initiatives.

- Tax Planning and Optimization: By accurately determining the fair market value of a company’s stock, a 409A valuation can assist in tax planning and optimization strategies, potentially reducing the tax burden for both the company and its employees.

How to Choose a 409A Valuation Provider

Selecting the right 409A valuation provider is crucial for ensuring an accurate and compliant valuation process. Here are some key factors to consider when choosing a provider:

- Expertise and Experience: Look for providers with a proven track record of conducting 409A valuations for startups in your industry or sector. Experienced providers will have a deep understanding of the nuances and complexities involved.

- Professional Credentials: Ensure the provider employs qualified appraisers with relevant certifications, such as the Accredited Senior Appraiser (ASA) or Certified Valuation Analyst (CVA) designations.

- Methodology and Approach: Evaluate the provider’s valuation methodologies and approach to ensure they align with industry best practices and regulatory requirements.

- Reputation and Client Testimonials: Research the provider’s reputation within the startup community and seek client testimonials or references to gauge their level of service and satisfaction.

- Responsiveness and Communication: Choose a provider that values open communication and is responsive to your needs, as effective communication is crucial throughout the valuation process.

- Pricing and Transparency: Compare pricing models and ensure transparency regarding fees and additional costs to avoid surprises or hidden charges.

409A Valuation Provider EQVISTA

By carefully evaluating potential 409A valuation providers based on these factors, you can increase the likelihood of a successful and compliant valuation process.

Also Read: The Total Count of Code Lines Revealed Windows 10 Analyzing

Frequently Asked Questions

Q: How often should a startup conduct a 409A valuation?

A: Startups are typically required to conduct a 409A valuation at least once every 12 months or more frequently if significant events could impact the company’s value.

Q: Can a startup perform a 409A valuation internally?

A: No, 409A valuations must be conducted by an independent, third-party appraiser to ensure objectivity and compliance with IRS regulations.

Q: What happens if a startup fails to comply with 409A regulations?

A: Failure to comply with 409A regulations can result in severe tax consequences for the company and its employees, including potential penalties, fines, and the taxation of stock options as ordinary income.

Q: How long does a 409A valuation typically take?

A: The duration of a 409A valuation can vary depending on the complexity of the company and the availability of necessary data. Still, it typically takes several weeks to complete.

Q: Can a 409A valuation be used for other purposes, such as fundraising or exit planning?

A: While a 409A valuation primarily focuses on determining the fair market value of a company’s common stock for equity compensation purposes, the insights gained can also be valuable for other strategic decisions, such as fundraising strategies or exit planning.

Conclusion

A comprehensive guide on 409A valuations is essential for startups to mitigate legal and financial risks, attract top talent, and instill confidence in potential investors. This process is not just a compliance exercise but a strategic imperative. A well-executed 409A valuation is a cornerstone of good governance, transparency, and informed decision-making.

Startups seeking to conduct a valuation can benefit from experienced professionals who understand 409A regulations and can provide a seamless and compliant valuation experience. This guide is designed to help startups unlock the full potential of their equity compensation strategy.