Business Success: The Power of Capital Injection Monievest

In the ever-evolving landscape of entrepreneurship, access to capital is often the make-or-break factor determining a business venture’s trajectory. Regardless of the industry or the scale of operations, every enterprise requires a consistent influx of funds to sustain growth, seize opportunities, and navigate through turbulent times. This is where the concept of capital injection comes into play, offering a lifeline to businesses seeking to unlock their full potential. I will discuss in this article, The Power of Capital Injection Monievest

Table of Contents

Understanding the concept of Monievest

Monievest is a pioneering platform that facilitates capital injection, empowering businesses with the financial resources they need to thrive. At its core, Monievest bridges the gap between entrepreneurs and investors, creating a symbiotic ecosystem where both parties can benefit from mutually rewarding partnerships.

The importance of capital injection for business survival

Capital injection is not merely a luxury but an essential ingredient for business survival and growth. Without adequate funding, even the most promising ventures can stagnate, unable to capitalize on emerging market trends or expand their operations. A company needs more capital to invest in research and development, hindering innovation and leaving it vulnerable to competitors better equipped to adapt to changing consumer demands.

Also Read: Top 10 Smart Curved TVs for an Immersive Viewing Experience

How capital injection can unlock business success

Capital injection through Monievest can be the catalyst that propels businesses to new heights of success. By providing access to the necessary funds, companies can:

- Expand their product or service offerings

- Invest in cutting-edge technologies and infrastructure

- Enhance their marketing and advertising efforts

- Acquire strategic assets or merge with complementary businesses

- Hire top talent and retain valuable employees

- Weather economic downturns and maintain operational resilience

These strategic investments, facilitated by capital injection, can elevate a business’s competitive edge, increase market share, and ultimately drive profitability and long-term sustainability.

Case studies of businesses that have benefited from Monievest

The transformative power of Monievest is evident in the success stories of numerous businesses across diverse industries. From a rapidly growing e-commerce startup that secured funding to scale its operations and expand into new markets to a manufacturing company that leveraged capital injection to upgrade its production facilities and enhance efficiency, the impact of Monievest has been profound.

One notable example is a tech-based logistics company that needed help to keep pace with the increasing demand for its services. Through Monievest, they obtained the necessary capital to invest in advanced fleet management systems and expand their delivery network, resulting in improved customer satisfaction and a significant boost in revenue.

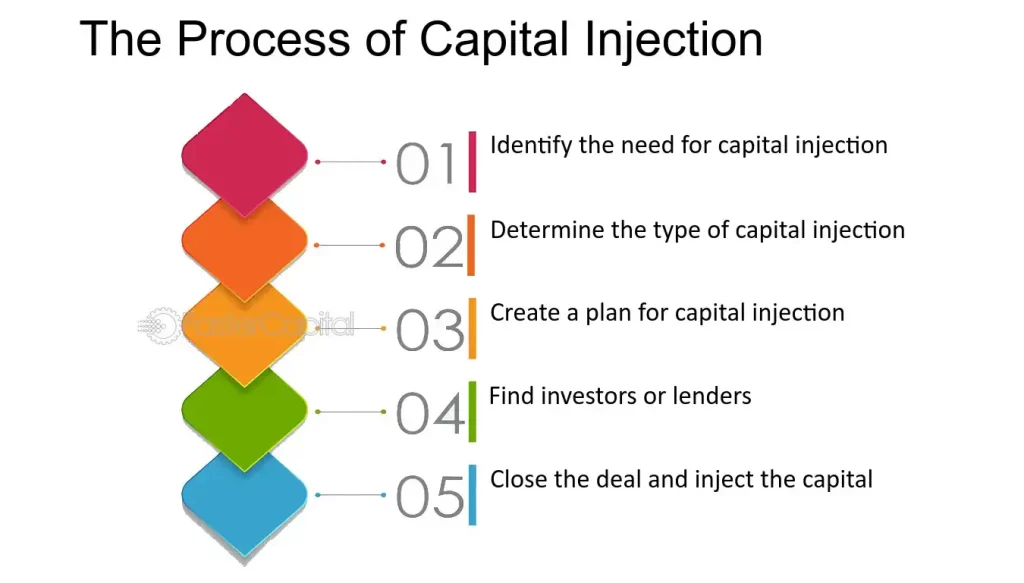

Steps to access capital injection through Monievest

Accessing capital injection through Monievest is a straightforward process designed to streamline the funding journey for businesses:

- Registration: Create an account on the Monievest platform and provide essential details about your business, including financial statements, business plans, and growth projections.

- Investor Matching: Monievest’s proprietary algorithms match your business with potential investors whose investment criteria align with your funding requirements.

- Due Diligence: Investors conduct thorough due diligence to assess the viability and potential of your business, ensuring a mutually beneficial partnership.

- Negotiation and Funding: Upon successful due diligence, you can negotiate the terms of the capital injection and finalize the investment agreement.

- Post-Investment Support: Monievest provides ongoing support and guidance to ensure the effective utilization of the invested capital and to facilitate communication between you and your investors.

Tips for successful capital injection in business

While capital injection can be a game-changer for businesses, it is crucial to approach the process strategically. Here are some tips to maximize the benefits of capital injection:

- Develop a Comprehensive Business Plan: A well-crafted business plan that outlines your growth strategies, financial projections, and risk mitigation strategies can increase your chances of securing investment.

- Maintain Transparency: Investors value transparency and open communication. Be forthcoming about your business’s strengths, weaknesses, and plans to build trust and credibility.

- Leverage Expertise: Seek guidance from experienced professionals, such as business consultants or industry experts, to refine your pitch and ensure you present your business in the best possible light.

- Allocate Funds Wisely: Once you receive the capital injection, allocate the funds judiciously, prioritizing areas that will yield the greatest return on investment and drive sustainable growth.

- Foster Investor Relationships: Maintain strong relationships with your investors by regularly updating your business’s progress and adhering to agreed-upon milestones and performance metrics.

Also Read: Fintechzoom Best Credit Cards for Savvy Spenders

Common misconceptions about capital injection

Despite its numerous benefits, there are several misconceptions surrounding capital injection that need to be addressed:

- Myth: Capital injection is only for struggling businesses. While it can provide a lifeline to businesses facing financial difficulties, it is also a strategic tool for thriving enterprises seeking to accelerate growth and capitalize on opportunities.

- Myth: Capital injection leads to loss of control: While investors may acquire a stake in your business, Monievest ensures that you retain control over key decision-making processes and the overall direction of your company.

- Myth: Capital injection is a one-time solution. It is not a one-time fix but an ongoing process that may require multiple investment rounds as your business scales and evolves.

Finding the right capital injection partner

Choosing the right capital injection partner is crucial for the long-term success of your business. Monievest simplifies this process by providing a curated network of reputable investors who share your vision and align with your business goals.

When evaluating potential investors, consider factors such as their industry expertise, track record of successful investments, and the level of support and guidance they can provide beyond just financial backing.

Frequently Asked Questions

Q: What types of businesses can benefit from Monievest?

A: Monievest caters to companies across various industries and stages of growth, from early-stage startups to established enterprises seeking expansion or diversification.

Q: How does Monievest protect the interests of both businesses and investors?

A: Monievest employs robust due diligence processes and legal frameworks to protect all parties’ interests. Transparent communication and clear investment terms are paramount.

Q: What is the typical investment range offered through Monievest?

A: The investment range varies depending on the business’s specific needs and the investor’s investment criteria. Monievest facilitates investments ranging from modest seed funding to substantial growth capital injections.

Q: How long does the capital injection process typically take?

A: The timeline can vary based on the complexity of the business and the due diligence required. However, Monievest strives to streamline the process, with the average timeframe ranging from several weeks to a few months.

Q: Can businesses access multiple rounds of capital injection through Monievest?

A: Absolutely. Monievest recognizes that companies may require additional capital as they scale and evolve. Successful partnerships can lead to follow-on investments or the facilitation of new investor connections.

Conclusion

Monievest is a capital injection platform that connects businesses with the right investors, enabling them to unlock growth opportunities and succeed. By connecting them with the right investors, Monievest helps companies overcome financial constraints, seize market opportunities, and position themselves for long-term sustainability. By leveraging Monievest’s power, entrepreneurs can unlock their full potential and achieve transformative growth.