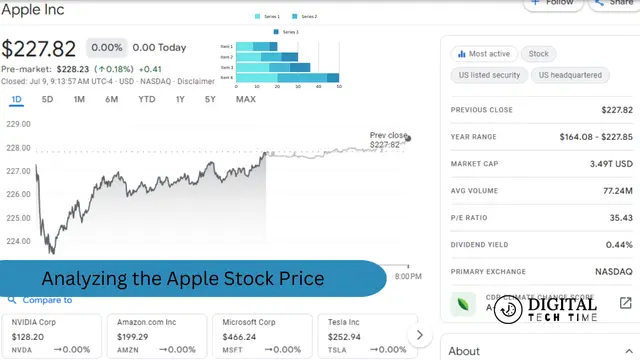

Analyzing the Apple Stock Price: What You Need to Know

As an investor or someone interested in the stock market, understanding the intricacies of stock prices is crucial for making informed decisions. This article will delve into the world of Apple Stock Price, one of the most widely traded and influential equities globally. By exploring the factors influencing its price, analyzing its performance, and utilizing technical analysis tools, you can gain valuable insights to navigate the ever-changing financial landscape.

Table of Contents

Understanding stock prices and their significance

Stock prices reflect a company’s perceived value in the market. They represent the equilibrium point where buyers and sellers agree on a share’s worth. The Apple Stock Price is a barometer of a company’s performance, growth potential, and overall health. Fluctuations in stock prices can have far-reaching implications for investors, traders, and the broader economy.

Factors influencing Apple Stock Fintechzoom price

A multitude of internal and external factors influence Apple’s stock price. Some key elements that shape its trajectory include:

- Financial Performance: Apple’s quarterly and annual financial results, including revenue, earnings, and profitability, play a significant role in driving its stock price. Financial solid performance typically leads to increased share value, while disappointing results can cause a decline.

- Product Launches and Innovation: As a technology giant, investors closely watch Apple’s ability to innovate and introduce game-changing products. Successful product launches, such as new iPhone models or groundbreaking services, can positively impact the stock price, reflecting the market’s confidence in the company’s future growth.

- Competition and Market Share: Apple operates in a highly competitive landscape, and its market share in various product segments can influence its stock price. Maintaining a solid competitive edge and gaining market share in emerging sectors can boost investor confidence and drive stock price appreciation.

- Global Economic Conditions: As a multinational corporation, Apple’s stock price is susceptible to global economic factors, such as economic growth, consumer spending patterns, and geopolitical tensions. Favorable economic conditions can boost demand for Apple products, while adverse conditions may negatively impact the stock price.

- Regulatory Environment: Changes in regulations, trade policies, and intellectual property laws can impact Apple’s operations and profitability, ultimately affecting its stock price. Investors closely monitor regulatory developments to assess potential risks and opportunities.

Also Read: Fix Peacock Not Working on Apple TV and Other Smart TVs

Analyzing stock prices

To make informed decisions about Apple stock, it is essential to analyze its price movements and trends. Here are some steps you can take:

- Track Apple stock performance: Monitor the stock’s daily, weekly, and monthly price movements, as well as its historical performance over more extended periods. This will provide insights into its volatility, trend patterns, and potential support and resistance levels.

- Utilize key indicators: Incorporate technical indicators, such as moving averages, relative strength index (RSI), and volume analysis, to identify potential entry and exit points for trading or investment opportunities.

- Conduct fundamental analysis: Evaluate Apple’s financial statements, management decisions, competitive landscape, and industry trends to assess the company’s intrinsic value and long-term growth potential.

- Consider market sentiment: Monitor news, analyst reports, and social media discussions to gauge market sentiment towards Apple. Positive or negative sentiment can influence stock price movements in the short term.

Technical analysis tools for evaluating Apple stock

Technical analysis is a powerful tool for analyzing Apple Stock Price and identifying potential trading opportunities. Here are some popular technical analysis tools that can be applied to Apple stock:

- Candlestick Charts: Candlestick charts provide a visual representation of price movements, including open, high, low, and close values for a specific time frame. They can help identify patterns and potential trend reversals.

- Trendlines and Channels: Drawing trendlines and channels on price charts can help identify the direction of the trend and potential support and resistance levels.

- Moving Averages: Moving averages, such as the simple moving average (SMA) and exponential moving average (EMA), can be used to identify trend direction and potential buy or sell signals.

- Oscillators: Oscillators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help identify overbought or oversold conditions and potential trend reversals.

- Fibonacci Retracements: Fibonacci retracements can identify potential support and resistance levels based on previous price movements, assisting traders in identifying potential entry and exit points.

Frequently Asked Questions

- What is the significance of Apple’s stock price? Apple Stock Price reflects the company’s perceived value in the market and serves as a barometer of its performance, growth potential, and overall health. It is closely watched by investors, analysts, and the broader financial community.

- How can I track Apple’s stock performance? You can track Apple’s stock performance through various financial websites, news outlets, and trading platforms. Many platforms offer real-time stock quotes, historical price charts, and analytical tools to monitor and analyze the stock’s movements.

- What are some key factors that influence Apple’s stock price? Key factors influencing Apple’s stock price include financial performance, product launches and innovation, competition and market share, global economic conditions, and regulatory environment.

- How can technical analysis tools help in evaluating Apple stock? Technical analysis tools, such as candlestick charts, trendlines, moving averages, oscillators, and Fibonacci retracements, can help identify potential trading opportunities, trend directions, and support and resistance levels for Apple stock.

- Is it necessary to conduct a fundamental analysis in addition to a technical analysis? While technical analysis focuses on price movements and patterns, fundamental analysis provides insights into the company’s intrinsic value, financial health, and long-term growth potential. Combining technical and fundamental analysis can provide a more comprehensive understanding of Apple’s stock and make more informed investment decisions.

Conclusion

Apple Stock Price analysis is a complex process involving various factors and analytical tools. Professionals can use candlestick charts, trendlines, and oscillators to identify potential trading opportunities and make informed investment decisions. To learn more about Apple stock analysis or seek professional guidance, consider subscribing to our newsletter or contacting financial advisors. Despite inherent risks, investing in the stock market requires thorough research, diversification, and seeking professional advice. By staying informed and using these tools, investors can confidently navigate the dynamic world of Apple stock.