How Startup Business Loans Can Propel Your Entrepreneurial Journey

As an experienced startup founder, I know firsthand the challenges and excitement of building a business from the ground up. One of the most critical elements of success is securing the proper funding to fuel your growth and development. In this article, I’ll explore how startup business loans can be a game-changer for entrepreneurs like yourself and provide practical insights to help you navigate the process.

Table of Contents

Why do startups need funding?

Starting a business requires significant upfront investment, from securing office space and equipment to hiring the right team and developing your product or service. Even the most innovative and well-planned startups often face cash flow challenges, especially in the early stages. Funding is essential to cover these expenses and provide the runway to get your business off the ground.

Access to capital is necessary for many promising startups to gain traction and ultimately succeed in reaching their full potential. Startup business loans can bridge this gap, giving you the financial resources to invest in your vision and lay the foundation for long-term success.

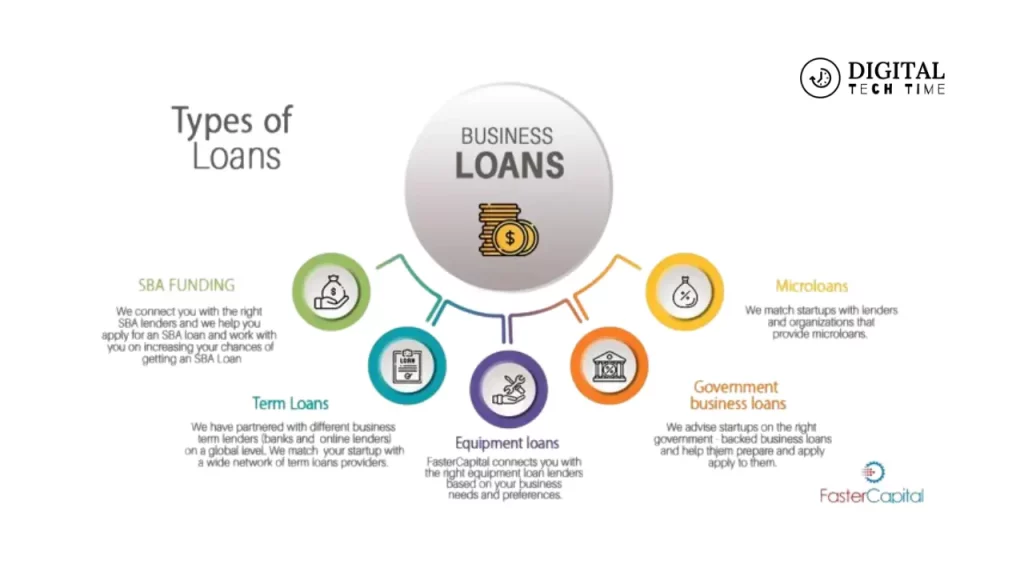

Types of Startup Business Loans

When it comes to financing your startup, there are several loan options to consider:

- Traditional Bank Loans: These are typically the most well-known and widely available type of business loan. Banks assess your creditworthiness, business plan, and collateral to determine loan eligibility and terms.

- SBA Loans: Backed by the U.S. Small Business Administration (SBA), these loans offer favorable terms and are designed to support small businesses, including startups.

- Online Lenders: Alternative lending platforms have emerged in recent years, offering a more streamlined and often faster application process than traditional banks.

- Microlenders: These lenders specialize in providing smaller loan amounts, making them an excellent option for early-stage startups with limited funding needs.

- Crowdfunding Loans: Platforms like Kickstarter and Indiegogo allow startups to raise funds from an extensive network of backers, often in exchange for rewards or equity.

How to qualify for a startup business loan

Securing a startup business loan can be challenging, as lenders often view new businesses as higher-risk investments. However, there are steps you can take to improve your chances of approval:

- Establish a Strong Business Plan: Lenders will want to see a well-researched and detailed business plan that outlines your market opportunity, competitive advantage, financial projections, and growth strategy.

- Build Your Credit: Personal and business credit scores are essential in loan approval. Take steps to build and maintain good credit, such as making timely payments on existing debts.

- Provide Collateral: Lenders may require you to pledge personal or business assets as collateral to secure the loan. These could include real estate, equipment, or inventory.

- Demonstrate Relevant Experience: Lenders are more likely to approve loans for entrepreneurs with prior industry experience or a proven track record of success.

- Seek Out Mentorship: Connecting with experienced entrepreneurs or small business advisors can help you navigate the loan application process and better understand the requirements.

Tips for applying

Once you’ve identified the right loan option for your startup, follow these tips to streamline the application process:

- Gather All Required Documentation: Lenders typically request financial statements, tax returns, business licenses, and other relevant documents. Having these materials ready upfront can expedite the review.

- Understand Loan Terms and Conditions: Carefully review the loan agreement to ensure you fully comprehend the interest rate, repayment schedule, and any fees or penalties.

- Explore Loan Alternatives: If you can’t secure a traditional business loan, consider alternative funding options like crowdfunding, angel investors, or venture capitalists.

- Maintain Open Communication: Stay in touch with your lender throughout the application process and be responsive to any additional requests for information or clarification.

Also Read: Master the Art of Using Google’s Cursive App on Any Laptop

Alternative funding options for startups

While startup business loans can be a powerful tool for growth, they may be better fits for some entrepreneurs. Here are some alternative funding options to explore:

- Equity Financing: Attracting angel investors or venture capitalists willing to exchange funding for a stake in your company.

- Crowdfunding: Raising funds from an extensive network of backers through platforms like Kickstarter or Indiegogo.

- Grants and Subsidies: Seeking out government-sponsored grants or subsidies that support small business development.

- Personal Savings or Loans: Leverage your savings or borrow from friends and family to finance your startup.

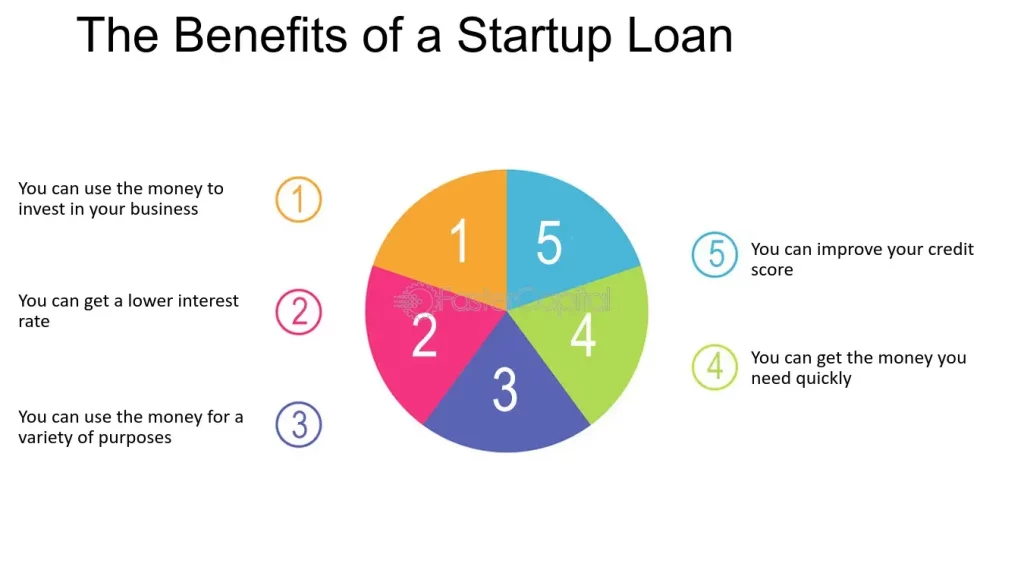

The Benefits of Startup Business Loans

Securing a startup business loan can provide numerous advantages for your entrepreneurial journey:

- Accelerated Growth: Access to capital allows you to invest in critical areas like hiring, marketing, and product development, helping you scale your business more quickly.

- Improved Cash Flow: Loan funds can help bridge gaps in your cash flow, ensuring you have the resources to cover day-to-day expenses and seize new opportunities.

- Establish Business Credit: Responsibly repaying a startup business loan can help you build a positive credit history for your company, making it easier to access financing in the future.

- Reduced Personal Risk: By separating your personal and business finances, a startup loan can help protect your assets and credit from the risks inherent in entrepreneurship.

Success stories of startups that used business loans

Many of the world’s most successful startups have leveraged business loans to fuel their growth and development. Here are a few inspiring examples:

- Airbnb: The online hospitality platform used a $600,000 loan from Y Combinator to expand its marketing efforts and attract more hosts and guests.

- Spanx: Sara Blakely, the founder of the shapewear brand, relied on a $5,000 personal loan to kickstart her business and bring her innovative product to market.

- Stripe: The online payment processing company secured a $2 million loan from venture capitalists, which it used to enhance its technology and customer service.

These stories demonstrate how startup business loans can be a powerful tool for turning bold ideas into thriving enterprises.

Frequently Asked Questions

Q: What is the typical interest rate for a startup business loan?

A: Interest rates for startup business loans can vary widely, ranging from as low as 5% to as high as 30% or more, depending on factors like your creditworthiness, the loan amount, and the lender. It’s essential to compare multiple-lender offers to find the most favorable terms.

Q: How long does the startup business loan application process take?

A: The timeline can vary significantly, from a few days for online lenders to several weeks or months for traditional bank loans. The complexity of your application, the lender’s review process, and the type of loan you’re seeking can all impact the turnaround time.

Q: Can I use a startup business loan for personal expenses?

A: No, startup business loans are intended solely for business-related expenses, such as purchasing equipment, hiring employees, or funding operations. Using the loan for personal expenses could be considered loan misuse and may result in penalties or default.

If you’re ready to take the next step in your entrepreneurial journey, I encourage you to explore the power of startup business loans. [Contact us today] to learn more about your financing options and how we can help you unlock your business’s full potential.

Conclusion

Startup business loans can be a game-changer for entrepreneurs like yourself. They provide the financial resources you need to turn your vision into a thriving reality. Understanding the different loan options, qualifying requirements, and application tips can position your startup for long-term success.

Remember, securing funding is just the first step – how you leverage those resources will genuinely determine your business’s trajectory. With careful planning, wise decision-making, and a willingness to explore alternative financing avenues, you can unlock the full potential of your entrepreneurial journey.