Protect from Cash App Scams: Stay Alert and Secure Finances

With the continued evolution in the digital payment landscape, Cash App scams have grown as a concern for many. In this comprehensive article, a look will be given into the various types of Cash App scams, their modus operandi, and, more importantly, practical tips on how one can safeguard finances and protect oneself from falling prey to such fraud.

Table of Contents

Signs of a Cash App Scam

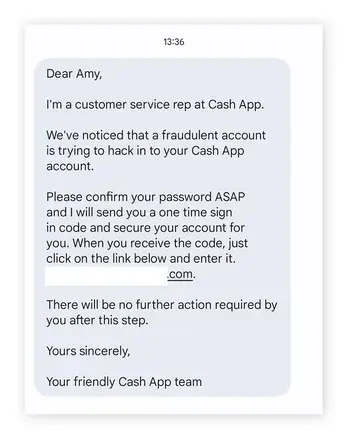

The signs will thus include unsolicited messages or calls claiming to be from Cash App support, solicitation of sensitive information, promises of free money or great investment opportunities that sound too good to be true, and finally, unexpected account activity or unauthorized transactions.

Tips to Protect Yourself from Cash App Scams

- Verify Authenticity: For any communication or account, verify that it indeed comes from the Cash App. Go directly to the official website of Cash App or their mobile application to engage only with the authentic representatives.

- Don’t Share Your Info: Never share your Cash App login credentials, PIN, or private financial information with anyone, not even with support from Cash App.

- Be wary of unsolicited offers-out-of-the-blue messages or offers promising money for free, an investment opportunity, or some other financial benefit are scams to hook you.

- Verify Transactions: Keep a close eye on your Cash App transactions and account activity. In any suspicious or unauthorized transaction, report it immediately to Cash App support.

- Enable Two-Factor Authentication: Allow two-factor authentication on the Cash App account to create an extra layer of security and prevent unauthorized access.

- Keep Software Updated: Make sure your mobile device and Cash App application are always updated with new features related to security and patches.

Reporting Cash App Scams

You report this incident, having fallen into the Cash App scam. You can do it by appealing for support, using a complaint with the Federal Trade Commission, or filing a case in your local police department.

Common Cash App Scams to Watch Out For

- Examples of common scams on Cash App include the following: scams through phishing, where the scammers send fake emails or texts, or even messages via social media, claiming to be Cash App support and soliciting sensitive information.

- Fraudulent Cash App Account Creation: Fraudsters create fake accounts and use them to solicit money from recipients or to carry out sham deals.

- Investment Schemes: Further, scammers can invite one to choose lucrative investment opportunities or get-rich-quick schemes via Cash App, only to have their money stolen.

- Unauthorized Transactions: Scammers have taken unauthorized entry to the victim’s Cash App account and made unauthorized transfers or purchases.

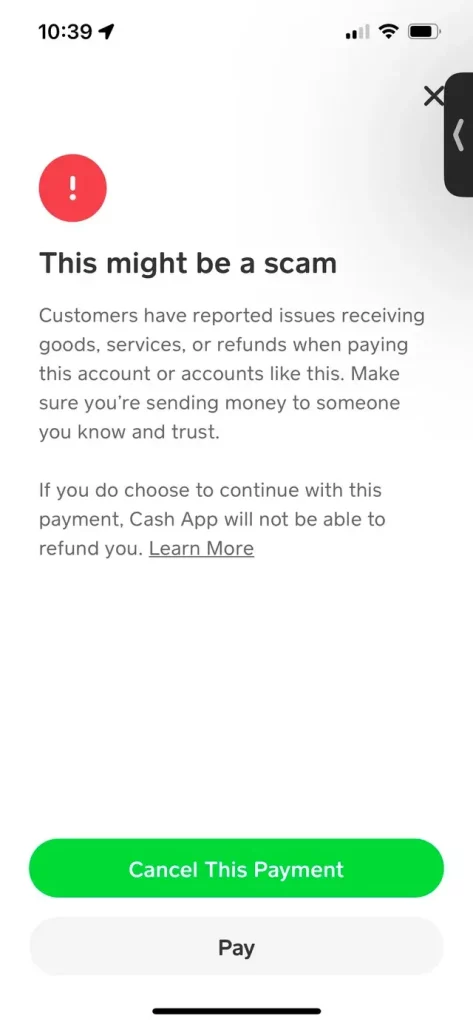

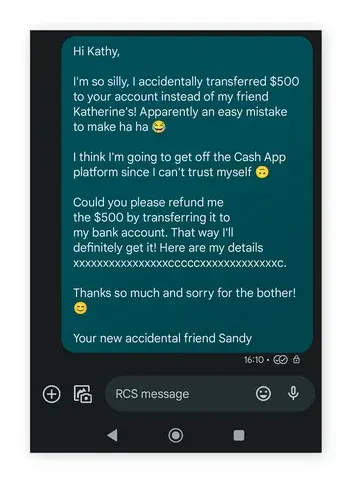

- Refund Scams: The scammer has accidentally issued money to you and would like a refund. Later, the original payment is reversed.

Real-life Examples of Cash App Scams

Most of the common Cash App scams include fraudsters pretending to be Cash App support staff and asking sensitive information in questions of login credentials or PINs to help resolve an issue with the victim’s account. Another example could be when scammers create a fake Cash App account to request money from potential victims in exchange for high investment returns or other financial benefits.

How to Secure Your Finances on Cash App

To secure your finances on Cash App, it is crucial to take the following steps:

- Enable Two-Factor Authentication: This helps introduce another level of security to an account, such that certain unauthorized access can be prevented in the Cash App.

- Use a Unique and Strong Password: Make sure you create a strong password for your Cash App account. Ensure it is unique and does not apply anywhere else.

- Regularly Monitor Your Transactions: Be keen as far as monitoring the activity and transactions happening over your Cash App account go.

- Do not reveal sensitive information about your login details on Cash App, PINs, or any other financial information to any person except an appointed Cash App support employee.

- Keep updating the software: Always keep the mobile device software updated, particularly the Cash App application, to enjoy all the benefits that result from the updated versions, including safety measures and patches.

Cash App Customer Support and Security Measures

Cash App is considerate of its users’ money security and has taken various steps to prevent fraud and scams. Furthermore, suppose you feel any fraudulent activity or suspect yourself to be a victim of some Cash App scam. In that case, you can always contact the Cash App support team for help in sorting it out, securing your account, or guiding you on how you could report it to higher authorities.

Also Read: How to Add or Remove Google Chrome extension

Frequently Asked Questions

Q: What should I do if I have been a victim of Cash App scamming?

A: In case one has become a victim of Cash App scamming, make sure that Cash App support is contacted without any delay. In addition, one is expected to report it to the Federal Trade Commission and other legal agencies in your locality.

Q: How will I know whether the message or account is real or not?

A: One important aspect to consider is that any update or account information should be verified through an official Cash App method found on its website or mobile application. Unsolicited messages or offers that sound too good to be true raise red flags, too, because scammers often try to make claims that are not believable.

Q: Is it possible to get my money back with Cash App if I have been scammed?

A: Well, recovering lost funds through Cash App scams is possible sometimes, but not at other times because the outcome is usually case-specific. Cash App has procedures in place to help those who fall victim to such frauds, and just because of this procedure does not mean that every case will be granted success. Again, people need to report it right away to support and concerned authorities.

Q: How do I prevent my Cash App account from being hacked?

A: Enable two-factor authentication, use a strong and different password for your Cash App account, and continually check your account activity for anything out of the ordinary. Never, ever give sensitive information to anyone, not even to those claiming to be Cash App support.

Conclusion

In essence, Cash App scams have become a big headache for many people. Knowing how they work, being ready for the different warning signals, and adopting the necessary measures in terms of security are some factors that can give you an edge over these malicious schemes. Be very aware and proceed with caution while using Cash App or any other digital means to pay money; that’s the key to keeping your hard-earned money safe.

If you have any other questions about scams involving Cash App, please do not hesitate to contact our certified financial professionals, who can provide further information on the best ways to protect your finances. We are here to help guide you through the ever-changing digital world and keep you safe and secure.